These platforms offer features specifically for variance analysis, including automated data integration, scenario modeling, and collaborative planning. By addressing these specific areas, businesses can improve their sales processes, align their offerings with market demands, and enhance their competitive position. If we calculate our variances correctly, the sum of Price and Volume variances should be equal to the total change in Profit Margin (excluding the impact of cost variances). Similarly the sum of Quantity and Mix variances should equal Volume variance. By the time, you are finished with the article, you will be able to understand clearly how to calculate these variances.

Create a Free Account and Ask Any Financial Question

I will try to be concise, so I assume you are already aware of terms like Sales, margin, profits and variance etc. If you are not fully aware, click on Commonly used financial terms every new Financial Analyst and Accountant should know! Also, start following our blog and YouTube channel LearnAccountingFinance, so that you can stay up to date with practical information and training (knowledge you can use immediately at your work). However, supervisors and production managers are responsible for labor efficiency and the number of materials. Moreover, department managers have the responsibility of handling the variances arising from purchases in a firm. It is the difference between the standard or baseline price and the actual amount paid for a service or an item to purchase.

Comprehensive Understanding of Sales Performance

By analyzing this data, the company decided to launch a promotional campaign offering discounts and bundling options, which helped regain market share and improve overall sales performance. In summary, the importance of analyzing both sales volume variance and sales price variance cannot be overstated. This dual analysis provides a comprehensive understanding of sales performance, identifies critical areas for improvement, and supports informed strategic decision-making. By leveraging these insights, businesses can enhance their sales processes, optimize revenue, and drive sustainable growth. The level of competition in the market can force companies to adjust their prices.

- It allows for customized calculations, data visualization, and the creation of detailed reports.

- The pricing strategy adopted by a company is a primary factor influencing sales price variance.

- Note that in the calculation of two sub Volume variances (Mix and Quantity) as well, we will use profit margin per unit and not Selling price per unit.

- The sales price variance quantifies the difference in sales that results from the difference in market price and standard price.

Stay on Track with Sales Variance

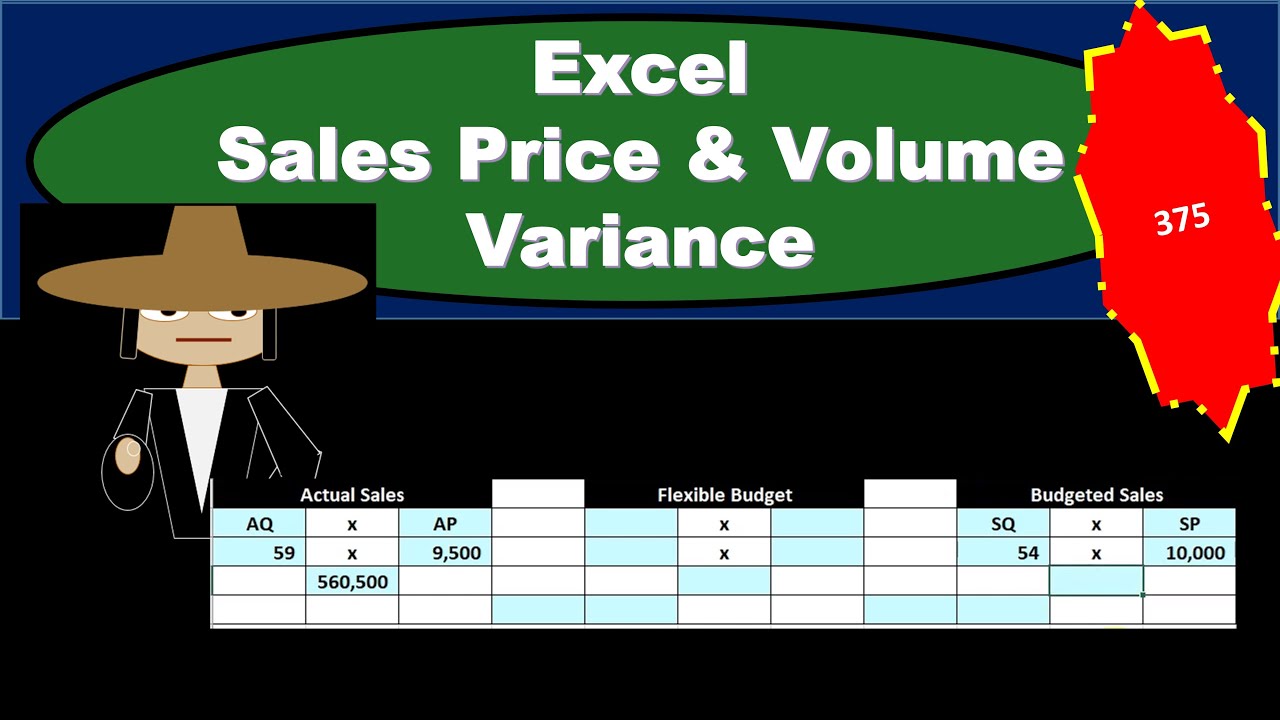

The example uses data for 2017 and 2018 (current year vs last year) to calculate the variances. However, if you are trying to calculate variances versus budget, simply replace last year (2017) with Budget data and the calculation will work just fine. Since the actual price $16 of the mug is below the standard price $20, the variance is adverse. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This is popularly known as the difference between revised standard sales and standard sales.

Brief Overview of Variance Analysis in Financial Management

The sales variance sometimes referred to as the sales value variance or revenue variance is the difference between the actual sales and the budgeted sales of the business. A positive sales price variance is considered favorable because receiving a higher price than you expected for each unit is a good thing. Sales price variance equals the difference between actual sales at the market price and actual sales at the budgeted price. Sales price variance is a helpful set of calculation for businesses to be aware of their products success in the market and how much they contribute in the overall sales revenue.

An unfavorable variance occurs due to a decrease in demand, an increase in competitors, a lower price ceiling, etc. If the selling price falls too low, the company might incur losses and discontinue a product line. taxable income on your 2021 irs tax return due in 2022 is a measure of the gap between the price point a product was expected to sell at and the price point at which the product was actually sold. The variance can be favorable, meaning the price was higher than anticipated, or unfavorable, meaning the price failed to meet expectations. Companies can use the information to adjust prices or shift their inventory to better reflect what customers most want to purchase. While variance analysis is a powerful tool, relying solely on quantitative data without considering qualitative factors can result in an incomplete understanding of sales performance.

For example, the adoption of e-commerce platforms has enabled businesses to reach a global customer base, significantly increasing potential sales volumes. Companies that leverage new technologies to improve their products and customer experience are likely to see a positive impact on sales volume. Product quality is a critical factor that influences consumer purchasing decisions. High-quality products that meet or exceed customer expectations are likely to result in repeat purchases and positive word-of-mouth referrals, thereby increasing sales volume. Conversely, poor product quality can lead to negative reviews, returns, and a decline in sales volume.

It is calculated by subtracting Standard Costs from actual costs, which gives us the net impact on profit. On the other hand, when unfavorable sales variance occurs it is because a company charges less for their product compared to what was budgeted. This scenario is more common in competitive markets where companies lower their prices in an effort to appeal to customers.

This understanding helps in making informed decisions that align with market conditions, cost structures, and overall business objectives. Sales volume variance is a metric used in financial analysis to measure the difference between the actual number of units sold and the budgeted or expected number of units sold. This variance highlights the impact of the difference in sales volume on the overall profitability of a business. By analyzing sales volume variance, businesses can identify whether they are selling more or fewer units than anticipated and understand the reasons behind this deviation. A manufacturing company producing consumer electronics used sales price variance analysis to assess the impact of market competition on its pricing strategy. When a competitor introduced a similar product at a lower price, the company experienced a negative sales price variance.

If competitors lower their prices, a business might have to follow suit to maintain its market share, resulting in a lower actual selling price. On the other hand, if a company has a competitive edge, it might be able to charge a higher price, leading to a positive sales price variance. The pricing strategy adopted by a company is a primary factor influencing sales price variance.

Economic factors such as inflation, recession, and changes in consumer purchasing power can lead to price adjustments. For example, during an economic downturn, businesses might reduce prices to stimulate demand, leading to a negative sales price variance. Now we are calculating the impact of change in volume (or number of units) and should exclude the impact of change in Profit margin in 2018.