Similarly, your liability accounts are a list of the debts your business owes to creditors. Naturally, items like accounts payable, invoices payable, interest payable, accrued liabilities, sales tax payable, and other liabilities fall within this list. In the bigger picture, it also makes it difficult to accurately gauge your organization’s financial health. Obviously, that makes your chart of accounts essential to a host of different people and groups, from your decision-makers and stakeholders to potential investors and lenders. But just because it’s important doesn’t mean it’s intuitive or straightforward, at least without true expertise guiding the way.

Income Statement Accounts

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. For example, if you had $10,000 in assets and $6,000 in liabilities, you’d have $4,000 in equity. This would include your accounts payable, any taxes you owe the government, or loans you have to repay. For standardization purposes, many industry associations publish recommended charts of accounts for their respective sectors. In addition to the universal general accounts that are prevalent in most entities, each entity will include certain accounts that are particular to its industry sector.

Download Accounting Chart of Accounts List templates

Use a spreadsheet program like Excel or Google Sheets to create your COA template. List your main categories (assets, liabilities, etc.) and assign numbers and names to each account within these categories. Ensure the numbers and names are easy to understand and reflect etf vs mutual fund the purpose of the accounts. This will simplify the process of recording and retrieving financial information. Our free template provides a ready-made structure, saving you valuable time and ensuring you have all the essential accounts categorized correctly.

Taxfyle resources

Further information on the use of debits and credits can be found in our bookkeeping basics tutorials. On the other hand, selling office furniture is NOT revenue because you aren’t a furniture business. Current liabilities are due within a year, whereas long-term liabilities are due in a year or longer. Our network of U.S. based Tax Pros are accredited and background-checked. With an average experience of 12 years, they are equipped to handle even the most unique tax situations, ensuring that no credit or deduction is overlooked.

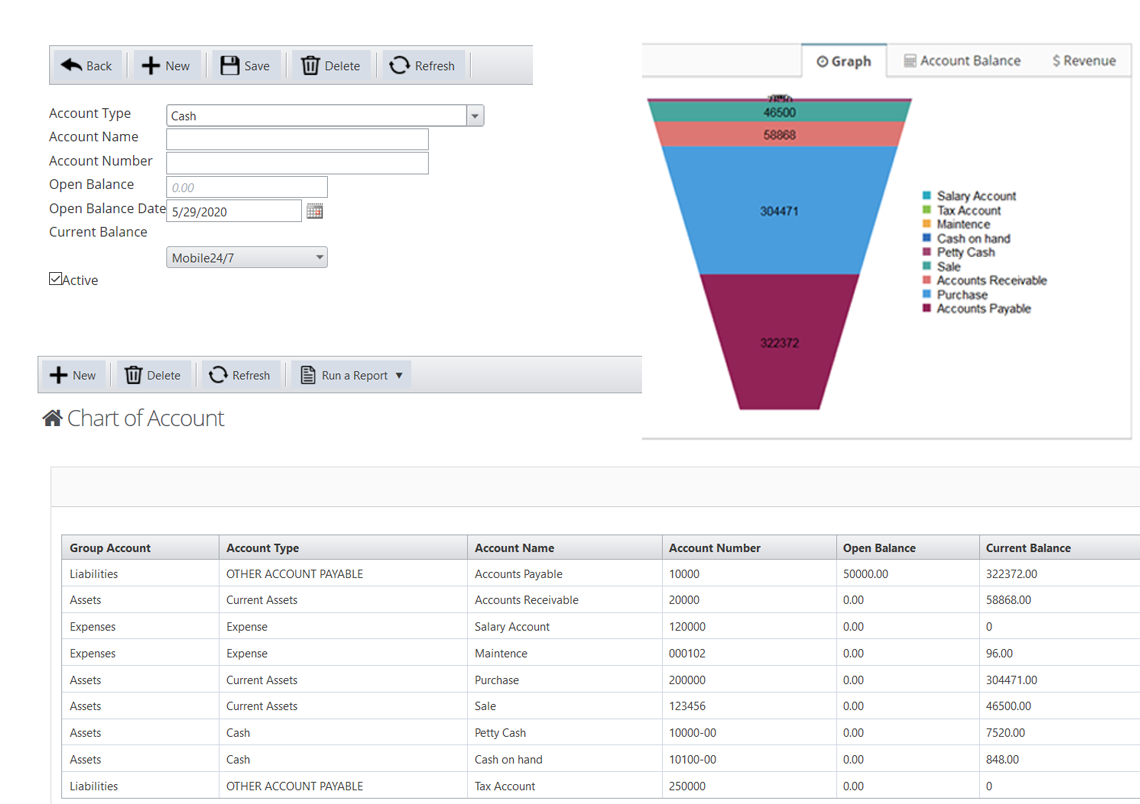

This chart of accounts example includes a variety of common account types and their typical numbering. Actual accounts and numbers can vary depending on each business’s specific needs and structure. Larger businesses may have more detailed accounts, including more specific sub-categories. The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities.

- This chart of accounts for small business template provides an example using some of the most commonly found account names.

- Consider the nature of your operations, the types of transactions you handle, and the financial reports you need.

- But ultimately, how effective it is in informing your decision-makers and ensuring an efficient record-to-report process is up to you.

- Review and refine your chart of accounts periodically to ensure that it remains relevant and accurate.

Download our FREE Excel chart of accounts template

If you’re making the leap from an overly simplistic or disorganized Chart of Accounts, it can be tricky to know what to include and what not to include. Our initial recommendation is to contact a firm like us to implement or refine your COA. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. There are a few things that you should keep in mind when you are building a chart of accounts for your business. As you can see, each account is listed numerically in financial statement order with the number in the first column and the name or description in the second column.

But when you start hiring a team, investing in tech, and investing in growth (aka you’re a venture backed startup) – this “Quickbooks Default” chart of accounts doesn’t tell you much. Of course, your particular industry will also determine how you customize your COA. While account identifier categories for the tangible costs of wells and development make sense for an upstream oil and gas company’s COA, they’d obviously be irrelevant for a chain of bakeries. A small business will likely have fewer transactions and accounts than a larger one, meaning a three-digit system of identification codes might suffice. Now, according to the standard definition of a COA, it should focus on the many different accounts tying into your company’s general ledger. And while your GL certainly plays a significant role, our advice is not to be so hyper-focused on the GL that you fail to integrate other dimensions and company attributes into your COA.

In short, this is a way to measure how valuable your organization is to its owners. For example, additional information like company and cost center lists flesh out simple transactional data, providing more nuanced insights that your leadership will undoubtedly benefit from. We’ll go into greater detail in a bit but, for the time being, just remember that you have a large degree of flexibility when it comes to building your COA and tailoring it to your specific needs.